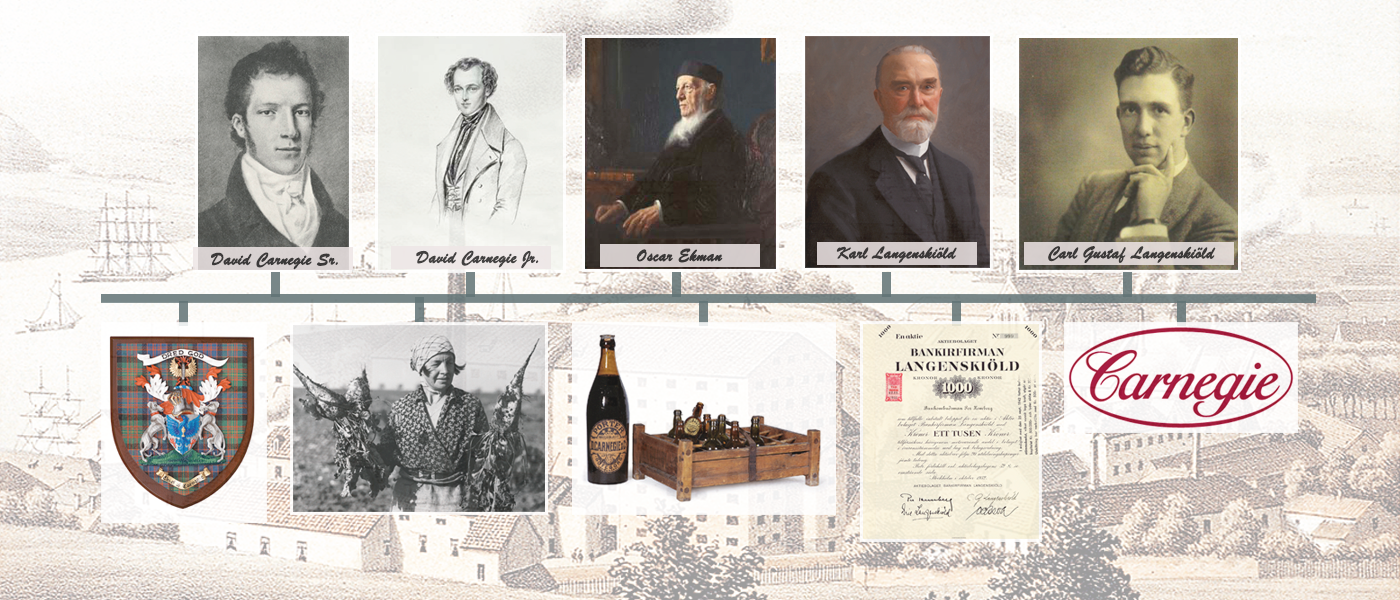

Carnegie has a long history and carries one of Sweden’s oldest registered trademarks. Thus, our corporate history is strongly intertwined with the industrial development over the past two hundred years. Below, you will find some of the most significant events forming our legacy.”

Some 215 years ago – One of Sweden’s most influential trading houses is born

There was a tangible Scottish influence on Swedish business in the mid-18th century, and several major Gothenburg trading houses were being run by Anglo-Saxon families at that time. One particular Scot arrived in 1786, and his name would come to be a part of the Swedish business community for over two hundred years. The then 14-year-old David Carnegie had traveled from the port town of Montrose in Scotland to learn how to be a trader alongside a close friend of his father in Gothenburg. Seventeen years later, on May 4, 1803, he registered the firm D. Carnegie & Co at the Gothenburg Courthouse, focusing on exports of iron and wooden goods.

Gothenburg was at that time a small town with a population of about 12,000, but with an established port and active shipping companies enabling it to support the import and export activities taking place. The city became an even more important port for international links in 1806 when Napoleon put in place a trade blockade between Britain and the rest of Europe. Gothenburg flourished, and the D. Carnegie & Co trading house expanded its business to include imports of flax, salt, wine, sugar, coffee, and tobacco, as well as exports of herring, tar, iron, and timber.

This laid the foundation for what would long be one of Sweden’s most influential trading houses.

Some 180 years ago – Sugar and porter drive Carnegie’s growth

In 1836, David Carnegie Sr. brought his nephew David Carnegie Jr. into the firm. After just a few years, David Carnegie Jr. became a partner and would prove to be a major driving force behind the company’s successful development.

Around the same time, David Carnegie Jr. sealed his first major deal under his own name and using borrowed money when he bought a sugar and porter plant in Gothenburg at a bankruptcy auction. For 200,350 kronor, he took over factories and stocks of sugar and porter. The business would eventually be merged into D. Carnegie & Co and contribute to strong economic growth for the company. In 1841, David Carnegie Jr. chose to return to Scotland and engaged his friend Oscar Ekman to lead the business in Gothenburg. He would successfully run the company for 62 years.

Under Ekman’s leadership, porter manufacturing was quadrupled, and profitability and growth increased dramatically. In about 1860, Carnegie’s sugar factory accounted for 30% of Sweden’s sugar production and employed around 200 workers. A further 300 were engaged at the porter brewery. As porter production thrived in the 1860s, it required ever-larger and more secure supplies of glass bottles. This led to the acquisition of the Årnäs glass factory, which was bought at auction in 1868. The supply of bottles was thus ensured, and glass manufacturing in the small factory town of Värnen would continue for another century. On January 2, 1885, the rights to the brands associated with the porter manufacturing were secured when Carnegie Porter was registered with the Swedish Patent and Registration Office. It is today Sweden’s oldest surviving brand.

Some 110 years ago – Real estate business in focus

There was a restructuring of the Carnegie firm in 1907, pushed by Karl Langenskiöld, who had taken over from his late father-in-law, Oscar Ekman. The company was divided into two separate entities: Porterbryggeri AB D. Carnegie & Co, and Fastighets AB D. Carnegie & Co. Until then, the real estate activities had been limited, and the biggest holding was the earlier acquisition of the Årnäs glass factory. When the porter brewery was divested to Swedish Vin & Sprit in 1920, however, the focus on real estate was intensified. Eventually, the glass production at Årsnäs also ended, and the property holdings increased in both Stockholm and Gothenburg. (The rights to Carnegie Porter were later transferred to Pripps, and today the D. Carnegie Porter brand is owned and marketed by Carlsberg.)

Some 90 to 50 years ago – The financial business takes off

In 1932, in parallel with the growing real estate business, Bankirfirman Langenskiöld was founded by Karl Langenskiöld’s son, Carl Gustaf Langenskiöld. The aim was to be able to streamline management of the family’s growing wealth directly on the Stockholm stock exchange, without any middlemen. Carl Gustaf Langenskiöld also managed to attract a few external customers who had survived the financial crisis. Brokerage revenue and commission in the first year of business amounted to 68,848 kronor (monetary value at the time), and the business employed three brokers. In 1935, Carl Gustaf Langenskiöld also took over the tiller from his father at the family business, Fastighetsbolaget D. Carnegie & Co. Twenty years later, the next generation took over when his son, Carl Langenskiöld, became managing director.

The activities in equity trading expanded as stock market turnover rose dramatically in the 1960s. At the same time, much of the real estate holdings were sold, and the capital was invested in shares. There was further restructuring in 1964, and a new corporate structure was established. Investmentaktiebolaget D. Carnegie & Co was created and listed on the Stockholm Exchange, as the parent of both the real estate company and the Langenskiöld investment bank (incorporated as a subsidiary). In 1970, the real estate company was sold entirely, and the share transactions gained real momentum, marking the company’s new financial direction. Within a couple of years, Carnegie had become one of Sweden’s largest brokerages and completed its first IPO in 1975 (Barkman & Co and Opus). The business eventually moved from Gothenburg to Stockholm, and in 1980, the company changed its name to Carnegie Fondkommission.

Some 30 years ago – 16,000 employees

In 1985, Sabaföretagen, then Sweden’s largest department store operator listed on the Stockholm stock exchange, made a high-profile acquisition of the Carnegie group. A new corporate structure was established in the merged group, with Investmentaktiebolaget D. Carnegie & Co promoted as the listed parent company, with around 16,000 employees in three underlying arms of business: – Retail and wholesale, including Åhlens, B&W, Hemköp, and Dagab – Funds and finance business, comprising Carnegie Fondkommission – Services and property operations.

Within three years (1988), the Carnegie group (Investmentaktiebolaget D. Carnegie & Co) sold most of the wholesale and retail operations (the old Sabaföretagen) to Axel Johnson AB for 3.5 billion kronor. Within another two weeks, Carnegie Fondkommission (including the subsidiaries in London and New York) was also sold, to state-owned PK Banken (now Nordea) for 2.7 billion kronor.

International expansion

A department specialized in trading Swedish equities to international clients was opened already in 1979. This was the starting shot for the international activities. In 1982, Carnegie participated in the first IPOs of foreign companies on the Stockholm stock exchange.

The international establishment continued during the 1980s and 1990s, and Langenskiöld investment bank changed its name to Carnegie Fondkommission (owned by Investmentaktiebolaget D. Carnegie & Co). In 1983 Carnegie was the first Swedish firm to apply via the Riksbank to form a company abroad, as the London office was established. The list below shows the years in which Carnegie would come to establish additional offices and subsidiaries in key cities:

1986 – Malmö

1987 – New York

1989 – Madrid, Oslo, and Copenhagen

1990 – Milan

1991 – Helsinki, Gothenburg

1992 – Lisbon

1993 – Luxembourg

2018 – Linköping

Some 20 years ago – Re-listing on the Stockholm Exchange

In 1994 the British merchant banking group Singer & Friedlander acquires the Carnegie Group from Nordbanken (previous PK Banken, currently Nordea). The ownership was controlled and divided through the newly formed company Carnegie Holding, where Singer & Friedlander owned 55 percent and employees of Carnegie (through the company D. Carnegie & Co) owned the remaining 45 percent.

Six years later, following a decision to list the Carnegie Group, Carnegie Holding was merged with D. Carnegie & Co, with the latter to become the Parent company of the Group. And on June 1, 2001, D. Carnegie & Co was listed on the Stockholm Exchange. The offering was subscribed more than 30 times, and the market capitalization at the offering price was SEK 7.7 billion.

Recent years

In the wake of the financial crisis of 2008, the Swedish National Debt Office takes over ownership of Carnegie, and the company is delisted from the stock exchange. In the beginning of 2009, Carnegie is sold to the private equity firm Altor and the investment company Bure. A new strategic roadmap allows Carnegie to gradually regain its market position, and by 2010 the position is reinforced as Carnegie acquires its competitor HQ Bank and HQ Fonder. Since, Carnegie has continued its strong development and established a leading market standing in all areas of operations, while gradually increasing its focus on advisory services in the Nordic.